This is by far the most tedious part of the process. We purchased this place with 20% initially, so I knew there would not be an issue on the refinance because the loan balance was well under the value of the property. I assume they were able to do this online using comps from the area. No one came to my house to do an appraisal. This was handled quickly and without much fuss. They gave me the green light, so it was time to move forward I thought. But I was taken in by the fact that Quicken Loans didn’t seem deterred by my self-employment income.

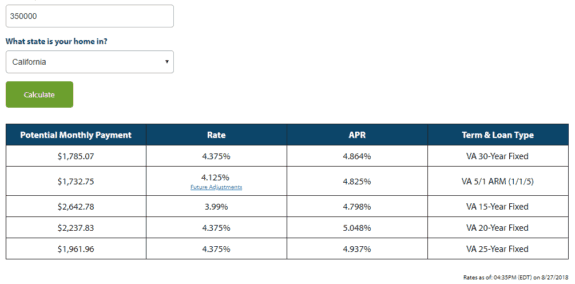

A more diligent, prudent person might have taken the loan details and then shopped some other lenders. Deposits can be from $400 to $700 according to the Quicken Loans website. I felt comfortable moving forward and I paid for the deposit using my Chase Freedom card. I can’t speak for them, but I can say that Quicken Loans wouldn’t be in business very long if their sole interest were to rob unqualified people of $500. Many people have come online to complain about losing money due to this deposit. There is a bit of controversy surrounding this deposit. If your application gets denied you are refunded the deposit less any fees they have incurred. Paying this allows Quicken Loans to lock your rate, set up an appraisal, process your application, and generally get serious about doing business with you. Quicken Loans has a non-refundable deposit that you are required to pay. If I was cool with that then we could then go forward with the actual application, once a deposit of $500 was paid. Good Faith Estimate and Depositīefore that conversation ended, I was told that everything looked good and I could now log into my Quicken Loans online account to see my good faith estimate, which included my interest rate and term (30 years, in my case). I gave Eric more information about my income, employment situation, loan type, and more. I called them up and spoke with my Mortgage Banker, Eric Pacifi.

I received an email from Quicken Loans that my credit had been pulled and they were ready to discuss mortgage options. Someone from Quicken Loans reached out to me and I gave permission for my credit to be pulled. After clicking “learn more” I was taken to the Quicken Loans site and filled out the contact form. I’ll be honest, I was lured in by the fact that I’m familiar with the Quicken name brand. I used my own mortgage rate table and found a reasonable rate from Quicken Loans. Quicken Loans breaks down the mortgage loan process into 7 simple steps. What I will focus on is how they did business with me. You already know them as one of the biggest names in home mortgages, with “highest in customer satisfaction for primary mortgage origination” according to J.D. I’ll save you the info on Quicken Loans themselves. But I can tell you about my particular experience and let you decide if working with Quicken Loans on your purchase or refinance is right for you. But I’m also pleased with the process of doing the refinance with Quicken Loans. I’m certainly pleased with the financial outcome of the refinance, and I certainly encourage you to check mortgage rates to see if you can find savings on your mortgage. Doing so lowered our payment by $186 a month, and saved us $22,000 in interest payments across the life of the loan. When we refinanced our mortgage, we used Quicken Loans.

0 kommentar(er)

0 kommentar(er)